Table Of Content

- How to find private landlords near you

- California Rental Laws Are Changing in 2024: What Landlords Need To Know

- How to build credit from scratch

- Can I Rent an Apartment With No Credit Score?

- Housing articles

- What Do Apartment Managers Look for in a Credit Report?

- Q: What is the process for renting a house without undergoing a credit check?

This article is for informational purposes only and is not a substitute for professional advice from a licensed attorney, tax professional, or financial advisor. Banking services provided by Community Federal Savings Bank, Member FDIC. Many or all of the products featured here are from our partners who compensate us.

How to find private landlords near you

The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Figuring out how to rent with bad credit takes some creativity, though it’s not impossible. The good news is many landlords will still consider responsible tenants that can prove their financial stability or offer an extra incentive, like renting with a roommate. Now is the time to make on-time payments across your credit cards, loans, and report your rent payments to credit agencies.

California Rental Laws Are Changing in 2024: What Landlords Need To Know

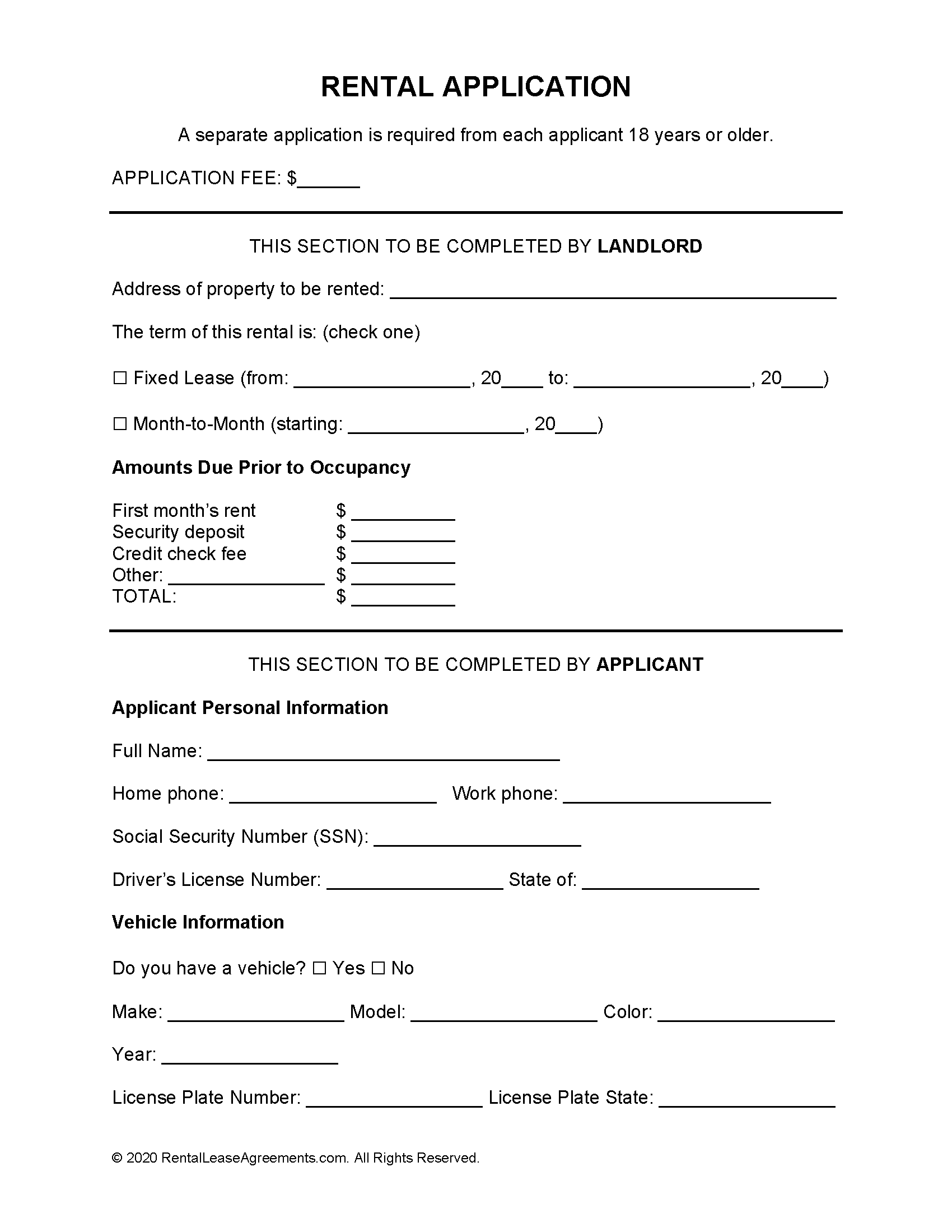

If this isn’t the case, however, then an acceptable proof of income, or a co-signer or roommate with a much higher credit score may be needed. Not only does this show your landlord that you’re financially capable, but also that you’re serious about renting the property and aren’t afraid to put your money where your mouth is. Have you ever seen the words “apartments for rent no credit check,” or “private landlord no credit check” in your local classifieds or advertised online? No doubt, this is the work of a private landlord, who is desperate to fill his or her rental properties with tenants to ease the financial burden of a mortgage, utilities, and property taxes. Once you've signed the rental lease, having your landlord report your rent payments to credit bureaus can help you establish credit or improve your credit score. If your landlord doesn't already do this, see if you can convince them to start, or if they will let you pay via a rent payment service that works with Experian.

How to build credit from scratch

How To Lease A Car With Bad Credit - Bankrate.com

How To Lease A Car With Bad Credit.

Posted: Mon, 23 Oct 2023 07:00:00 GMT [source]

Although you can sometimes find no credit check apartments, in most cases you’ll need a credit score of at least somewhere between 600 and 620. A score of 700 or above is considered good and anything 800 and above is excellent. Apartment management companies and condominium associations will most likely perform a credit check on an applicant and base their decision solely on this information. Your interest in becoming their tenant could mean they’re willing to compromise with your lack of credit history.

It may go a long way in transforming their impression of you from a person with a bad credit report to a renter who wants them to be profitable. You might still be able to convince the leasing office that you’ll pay your rent on time. Even if you have no credit history or poor credit, there are still ways you can sign a lease. It may just take a little persuasion, explanation of credit dings and proof that you’re a good renter.

Housing articles

“It’s really a marker as to how you feel about responsibilities.” Here are helpful tips for how to rent without a credit check. Renting a house or apartment with no credit history can present a challenge, but it’s certainly possible. For no credit check apartments, seek out those offered by private landlords, as they may be more lenient about credit history. A no credit check apartment is an apartment that can be rented by anyone regardless of their credit history. The landlord or property manager does not check your credit report during the application process, instead relying on other information to prove that you can make your rental payments on time. Another way to find a no-credit-check rent-to-own property is by working with a private landlord.

What Do Apartment Managers Look for in a Credit Report?

And, because they already know and trust you, you may be able to get into your new place without jumping through so many hoops. Next to showing that you have plenty of money to cover costs, a glowing reference from another landlord (or several) is a great way to prove that you’re a safe bet as a tenant. Of course, this only works if you have a good relationship with a past landlord. If you do, simply reach out to your landlord and ask for a letter of recommendation. If they’re not interested in upfront payments, ask them what would change their mind.

Q: What is the process for renting a house without undergoing a credit check?

Having a roommate may be useful for people who have a high income with poor credit. You should still be prepared to offer a letter of explanation and recommendations from past landlords. They’re likely interested in getting good deals and maintaining positive cash flow.

Make On-Time Payments

If they have a history of excellent credit and a high limit, you may experience a substantial credit score boost as an authorized user. Individual landlords will be more likely to rent to you if they have the rent money in hand for a few months. By paying two to three months upfront, your landlord won’t run the risk of you not paying, at least for a while. Make sure this payment is well documented, so you can get it back at the end of your lease. Another way to build credit is by getting an installment loan and paying it off on time every month.

Websites like Zillow and HotPads list rentals from private landlords who might not ask for your credit history. Finding a house for rent with no credit check is easier when you target private landlords. They often skip the formal credit checks that larger rental property companies use. Many times they are new landlords who may not have had a chance yet to be tarnished by bad tenants.

Landlords run credit checks to ascertain how likely you'll be to pay rent on time and in full every month. You can take steps to increase your chances of approval by following these seven tips for renting an apartment with no credit. Consider providing copies of your cellphone and utilities payment history and information about accounts missing from your credit report to show you’ve been making regular payments. You could also provide a bank statement showing you have a financial cushion, even if it’s small. Most landlords will use FICO credit scores to determine if an applicant qualifies for an apartment.

No comments:

Post a Comment